Housing is a bundled good, comprising both improvements and land. The improvements correspond to the built environment on which human activities are performed, while the land is valued only according to its location characteristics, in the form of residual location-based land rent. The taxation of this land rent has been conceptually and empirically demonstrated to be the ideal source of public finance.

Regardless of the soundness of existing theoretical approaches to land taxation, and abundant empirical evidence corroborating its positive role on economic development, land taxation has been scarcely used in the United States, and quite the opposite, there are many cases where property taxes have been weakened. Proposition 13 in California is a telling case of property tax weakening.

Proposition 13 was passed as a tax relief measure in California in 1978, a high-price and high-growth housing market. This policy has already accumulated almost 50 years of limited increases in cadastral value assessments. Existing academic evidence has highlighted that Proposition 13 has worsened affordability, exacerbated inequality, and decreased housing production in California. However, it continues to be popular among voters and policy makers of all affiliations, due to its small benefits being clearly visible in long-standing homeowners’ tax bills, while its large losses remain mostly invisible in the form of a massive crisis of affordability for renters and currently aspiring homeowners. Our paper contributes by offering a conceptually driven set of tests that makes visible the unaffordability effect of low valuation assessments, emphasizing the relationships between two key ratios: a) the ratio between market price and total cadastral value; and b) the ratio between cadastral land and improvements value.

We build upon urban land rent theory, offering a new spatial approach to the Henry George theorem in the context of a simplified Rosen-Roback urban economics framework. The conceptual framework distills into a graphic representation of the long-run increasing effect of Proposition 13 on the ratio between land and improvement values, and of its increasing effect on the ratio between market and cadastral values. This framework requires us to verify the Georgian effect of a property tax where the improvements value is constantly undermined, and the land value comprises most of the housing total value in the long-run. This is the negative effect of the tax rate on the land value of a predominantly land-based property tax.

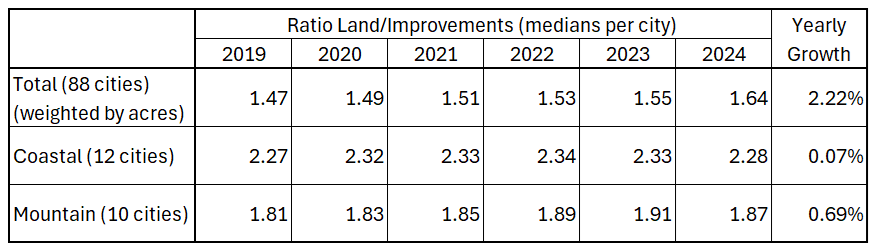

Our research merges two sources of housing values information, Corelogic for transaction prices, and Los Angeles County Assessor for cadastral values. With this data we compiled a panel database for the 87 cities in Los Angeles County during 2019-2024. The panel data regressions include OLS, IV, and SUR estimations to verify that the cadastral ratio has an increasing effect on the ratio between market housing prices and cadastral values, and that the cadastral ratio itself is determined by the housing prices. This long-run effect can also be verified by the higher ratio of cadastral land to improvements value that the most expensive cities of the county, located on the coasts and mountains, have when compared to county averages in the table below.

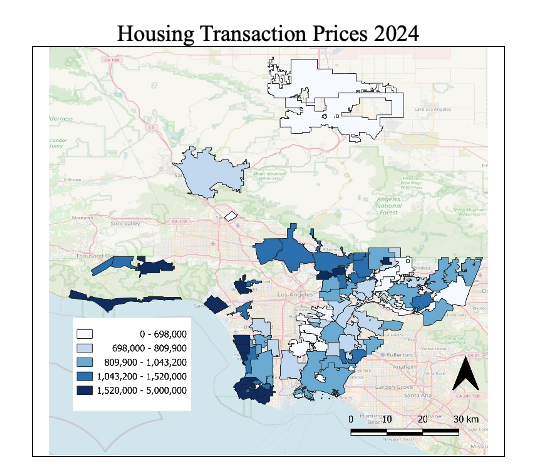

The table also shows that due to market saturation in those already highly priced coastal and mountain cities, lower priced cities are experiencing higher increases of the ratio, while the entire region shows almost completely stagnant sales and new development. The corresponding transaction prices for 2024 are reported in the graph below.

In addition to above, we use the regression exercises to verify that the property tax has a negative effect on the value of land, that is, it proves the Henry George theorem, precisely responding to the fact that Proposition 13 distortions have made cadastral land value disproportionate in relation to improvements. These results point to a policy reform proposal type split-rate or land-based property tax, while offering tax relief to homeowners.

It is an appealing idea to offer property tax relief to homeowners in markets experiencing high price growth. However, existing academic evidence and the use of urban land economics theory point to a less straightforward effect. The direct effect of assessment caps is a decrease of the tax burden, benefiting existing homeowners. Simultaneously, it reduces real estate rotation, decreasing housing supply and increasing its prices for new potential homeowners. We propose a land-based or split-rate property tax that offers relief on improvements, but charges all the property tax on the land value. This land-based tax should be less politically resisted than alternative options because according to our results it will decrease both key ratios in our analysis, making housing more affordable. It will also incentivize the re-development of the region’s currently derelict stock of housing and its inefficient retention of residential land.

* College of Business Administration & Public Policy, California State University Dominguez Hills. Carson, CA.