Denver is navigating a critical moment in housing and tax policy. Like many cities, the post-COVID period has seen widespread commercial & retail vacancies, rapidly-rising property values, and mounting pressure to build more housing. Because land value tax (LVT) can help solve all of these problems, there is growing local interest in this innovative policy.

Colorado’s Jared Polis is often considered the most “urbanist” governor in the nation, and has embraced both LVT and the YIMBY movement. While his flagship push to end single-family zoning statewide fell short, smaller reforms have made their way into law, including legalizing ADUs, eliminating parking minimums, and encouraging density near transit.

Meanwhile, spiking property values led to a backlash against property taxes and the creation of the 2024 Commission on Property Tax. Polis urged the commission to consider LVT, arguing it would curb speculation and support sustainable growth. In response, PPI’s Stephen Hoskins and local housing economist Luke Teater presented evidence showing that LVT could boost construction and reduce rents. But the commission ultimately declined to endorse it, instead recommending expanded tax relief programs.

“Land Value Tax & Snacks” in Denver

It was within this context that PPI was hosted by YIMBY Denver for an evening of “Land Value Tax & Snacks” discussions at the Denver Athletic Club on July 30th. After enjoying appetizers and drinks with the approximately 40 attendees, the formal program began with a presentation by PPI Executive Director Josie Faass, and Director of Community Research & Engagement, Stephen Hoskins. The evening’s focus was a timely one: Could a land value tax (LVT) help address Denver’s overlapping housing, land use, and property tax challenges?

Josie opened the presentation by explaining how an LVT works: it’s similar to a traditional property tax, but shifts the tax burden away from buildings and onto land. That simple change, she explained, has powerful effects: discouraging land speculation, encouraging productive use of land, returning community-created land value back to the community, and rewarding property owners who invest in homes and businesses. Josie highlighted economic research showing that LVT tends to promote renovation, boost local business activity, support infill development, and reduce sprawl, all of which resonate strongly in a city grappling with housing scarcity and uneven growth.

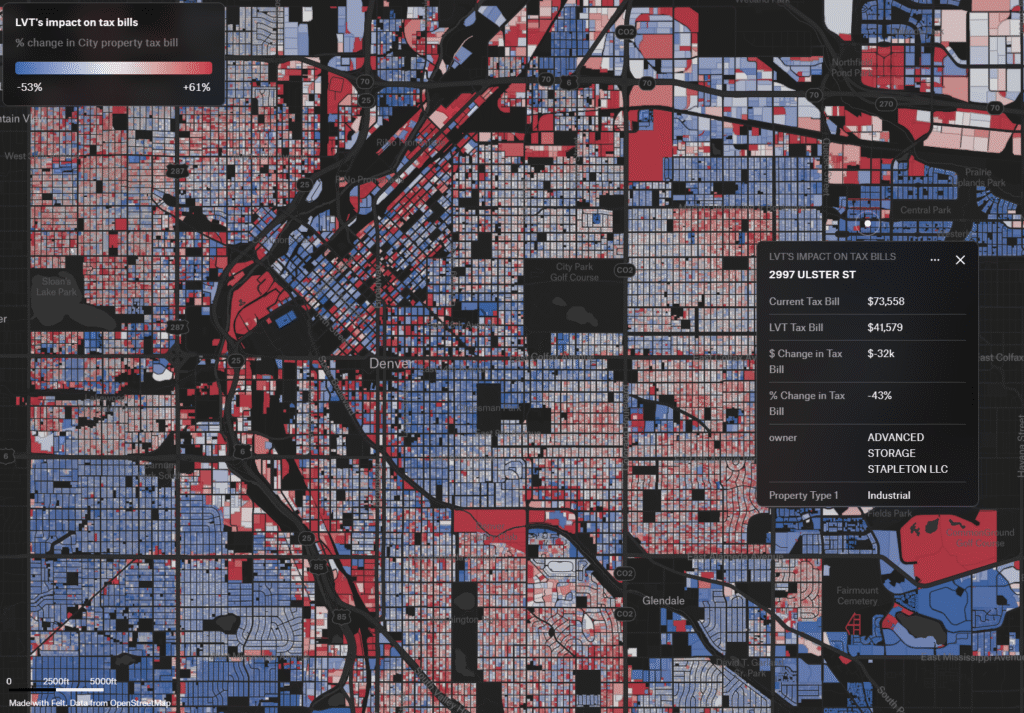

Stephen followed with new findings from PPI’s modelling of an LVT shift for Denver County. His analysis showed that a revenue-neutral shift to an LVT would lower tax bills for roughly three-quarters of single-family homes and 90% of multifamily buildings. Instead, the tax burden would shift onto vacant lots, surface parking lots and golf courses, helping to realign the tax system in a more equitable and efficient direction. Stephen showed that an LVT would be strongly progressive in Denver, providing the largest tax cuts to neighborhoods in the bottom 60% of the local income distribution and benefitting renters citywide.

Panel Discussion

Following the presentation, Josie & Stephen were joined for a panel discussion by two local LVT champions: State Senator Nick Hinrichsen and Luke Teater of Thrive Economics. The panel was moderated by Matt Larsen of YIMBY Denver, who guided the discussion through questions around the local politics of LVT and its intersection with YIMBY objectives. Among the highlights:

● Legality: Panelists clarified that Colorado’s Taxpayer Bill of Rights (TABOR) and constitutional uniformity clauses do not prohibit an LVT. However, enabling legislation would be needed to create separate tax classifications for land and improvements.

● Local impact: Attendees were eager to understand how an LVT might affect high-profile redevelopment sites like the stadium district, and the way in which parks and historic districts influence land valuations and tax bills under LVT.

● Developer Concerns: A thought-provoking discussion was prompted by an audience member questioning whether assessment methods currently over-value land on sites where changing macroeconomic conditions mean that development has become infeasible in the short-term.

● Political strategy: The panel discussed why LVT efforts have faltered in places like Detroit, ways to effectively message the policy, and explored how a strong YIMBY coalition could help build local momentum towards implementation.

The evening wrapped with positive feedback from attendees, many of whom expressed interest in seeing LVT analyses extended to other Colorado cities, including Fort Collins and Longmont. Senator Hinrichsen confirmed that he intends to reintroduce his LVT legislation in some form during the next legislative session.

While the 2024 Property Tax Commission ultimately passed on recommending LVT, events like this demonstrate that there is growing grassroots and policymaker support for this innovative tax policy. Stay tuned for more updates as we continue building momentum toward a fairer, smarter property tax system in Colorado.

Check out our presentation to YIMBY Denver, and read our previous article about land value tax advocacy in Colorado.